Contract Accounts Receivable and Payasble (FI-CA) enables subledger accounting for receivables and payables, typically in industries that require processing of huge volumes of business transactions and business partners. It also enables necessary capabilities to manage accounts receivable and payable (e.g., open item management and account balance display) along with capabilities like dunning and interest calculation.

FICA is a cross-application component used in utilities, telecom, insurance, public sector and other industries. This solution makes it simpler to manage the operations for the businesses with a very large consumer base and expected to grow, needs to make millions of postings each single day.

Why FI-CA over FI-CO:

- Why FICA instead of Standard Account receivable & Payable

- Basis for industry & Customer specific function

- FICA is an industry-specific sub-ledger accounting system & it is a cross-application component used in SAP ISU , telecom, Insurance, and other utilites sectors.

- Business partner concept ,Document are assigned to BP and contract account and contract Enhance functionality.

- Agent friendly processing of accounting transation.

- Summarization of General ledger information.

- Business is B2C scenario and business has a very high population of consumers usually in millions.The business has periodic transactions there by every period we need to create millions of invoice

- Business partner represents the consumers. Using FICA we can create one or more contract account under Business Partner.

- Contract account master dada for FICA & thereby FI posting.

- Businesses requires mass processing and parallel processing

- Optimized storage space use thanks to the special document structure type

Key Features of SAP FI-CA:

-

Seamless Invoicing and Billing: - SAP FICA simplifies invoicing and billing by automating the generation of invoices and statements. With customizable templates and robust reporting capabilities, organizations can ensure accurate and timely billing, reducing errors and improving cash flow.

-

Efficient Collections Management: - Managing collections is a critical aspect of revenue management. SAP FICA offers tools to streamline collections processes, enabling organizations to prioritize and track outstanding payments, set up payment plans, and automate reminders for overdue accounts.

-

Real-time Financial Insights: - SAP FICA provides real-time visibility into financial data, allowing organizations to make informed decisions. With comprehensive reporting and analytics, you can gain insights into revenue trends, customer behavior, and the overall financial health of your business.

-

Integration Capabilities: - SAP FICA seamlessly integrates with other SAP modules, such as SAP ERP and SAP CRM, ensuring data consistency across your organization. This integration simplifies processes and reduces data duplication, enhancing operational efficiency.

-

Compliance and Regulatory Support: - Staying compliant with changing regulations is crucial. SAP FICA helps organizations adapt to evolving financial regulations and standards, reducing compliance risks and ensuring financial integrity.

-

Enhanced Customer Experience: - A positive customer experience is vital for revenue growth. SAP FICA enables personalized customer interactions by providing a 360-degree view of customer accounts, helping organizations deliver exceptional service and build lasting customer relationships.

SAP BRIM

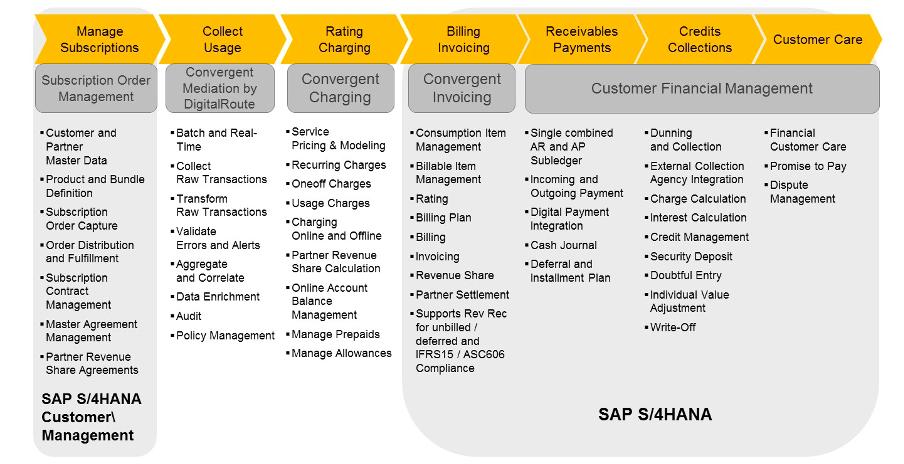

Financial Contract Accounting (FI-CA) is part of the SAP Billing and Revenue Innovation Management (BRIM) solution. (image.png)

The Order-to-Cash (O2C) process is covered by SAP Billing and Revenue Innovation Management. The process starts in SAP S/4HANA for Customer Management and ends with the contract and order creation.

The Usage-To-Cash (U2C) process starts after the sales and fulfillment processes are completed. The main process steps are charging and rating (SAP Convergent Charging), followed by billable items management, billing and invoicing (SAP Convergent Invoicing). After invoicing, SAP Customer Financial Management ensures a consistent process flow, supporting, among other things, Contract Accounting, Collection Management and Revenue Management

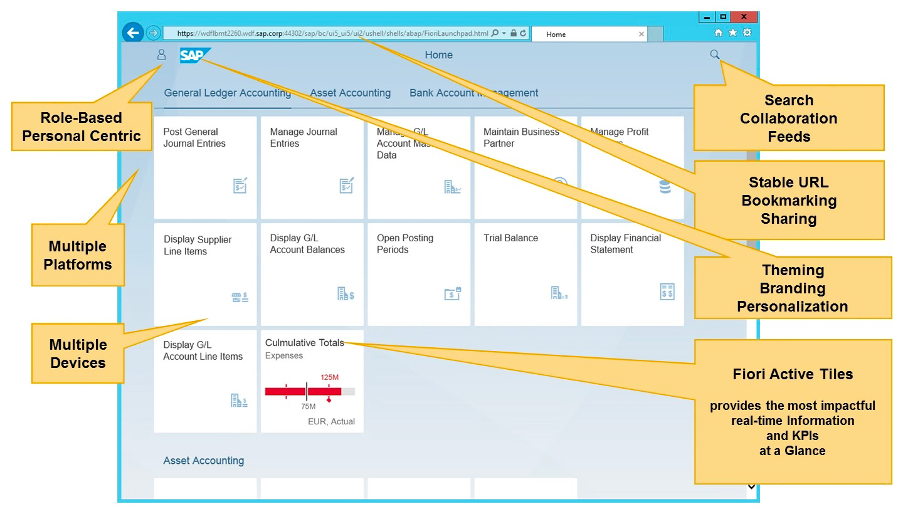

SAP Fiori

You want to ensure that your users have the best possible experience when interacting with SAP Business Suite. You want to ensure that users can access critical business applications on any device without compromises. Finally, you want to ensure that the solution integrates with your existing IT system landscape and can expand to cover your specific needs. You want to make sure that SAP Fiori meets these requirements.

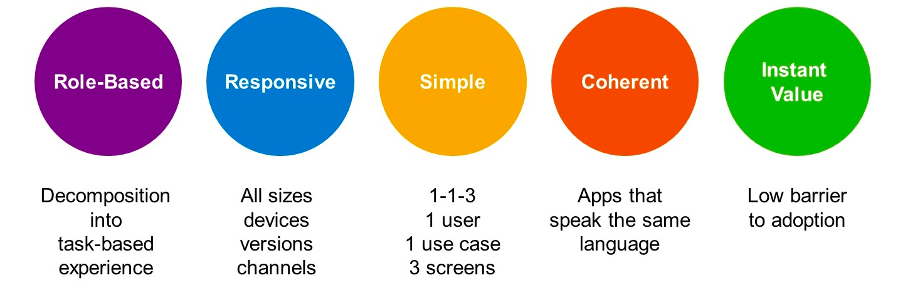

The SAP Fiori user experience paradigm consists of the following pillars:

-

Role-based: Users have access to the applications where they perform their tasks, and the applications are specific to completing this task.

-

Responsive: The application interface is responsive; it adapts to the size and device used by the users to access it.

-

Simple: The scope of the application is simple. There is one user, one use case, and up to three screens for each application.

-

Coherent: The applications are developed with a coherent structure. The apps all speak the same language, and can be implemented in multiple landscapes and environments.

-

Instant value: A low adoption barrier provides instant value, both on the IT-system side and on the user-adoption side.

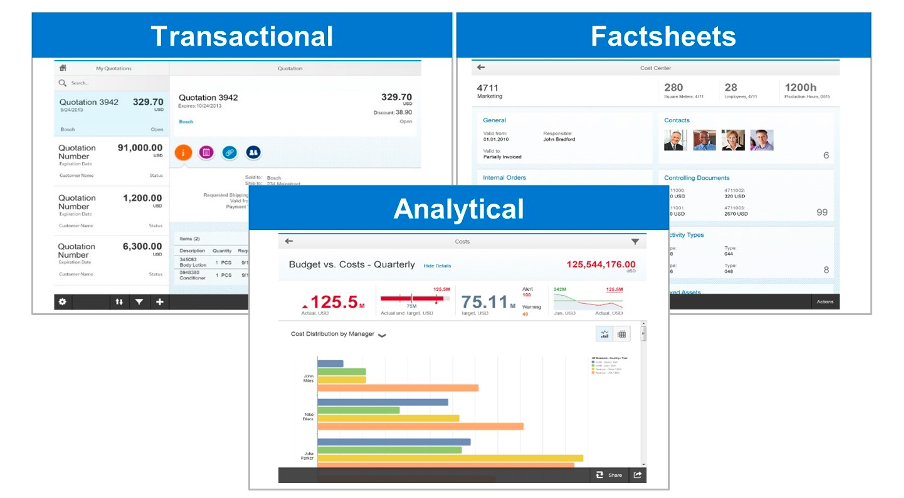

Different types of Fiori apps (UI5):

Typical Landing Page:

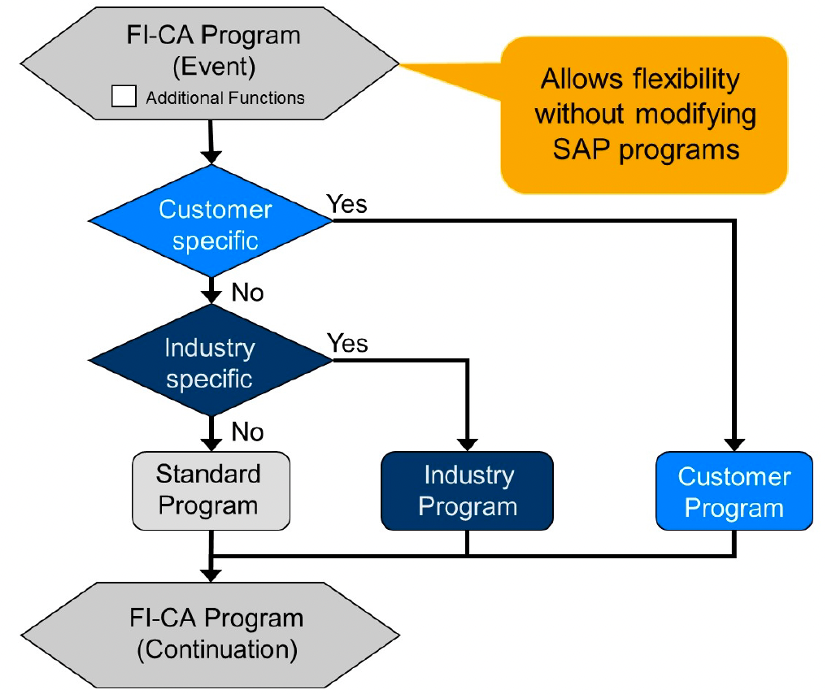

Events in FI-CA

You can use transaction FQEVENTS to maintain events and their function modules in FI-CA. You can use the function module FKK_FUNC_MODULE_DETERMINE to check the sequence:

- TFKFBM sample function module

- TFKFBS standard function module

- TFKFBC installation-specific function module

The technical name of the sample function module is formed from code FKK_SAMPLE* and the name (Number/ID) of the event. In the case of a sample function module defined at event 0010, the name would be FKK_SAMPLE_0010. If the Additional functions indicator is set, several industry-specific function modules and several customer-specific function modules can be processed. Along with events that are available to all industry components, additional industry-specific events also exist. You can recognize these from the encryption of the application area in the technical name.

From EventTo EventApplication00009999Application-IndependentM000M999MediaR000R999UtilitiesV000V999InsuranceP000P999Public SectorT000T999TelecommunicationX000X999Partner DevelopmentZ000Z999Customer DevelopmentS000S999Extended FI-CA[Link to learn more ] (click)

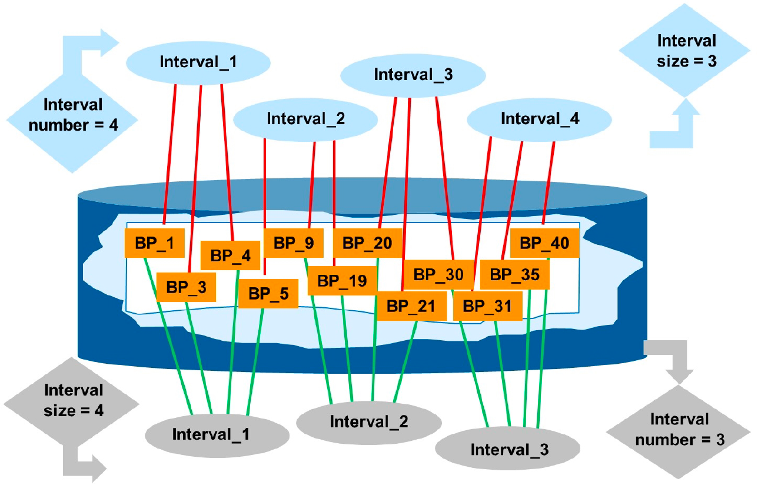

Mass Processing in FI-CA

Business processes, such as payment run or dunning run, in which large volumes of data are processed, are realized in FI-CA by using mass activities. Mass activities automatically split the dataset (such as a number of business partners or contract accounts) into multiple technical jobs and process them in parallel, at the same time.

When processing data, the system automatically splits the dataset into multiple parallel jobs. The specifications for distributing the key for the parallel objects are saved in variants, which you must update periodically. For example, you can create a variant for business partners that splits the business partner set to be processed into ten equal intervals. During parallel processing, the system makes sure that the processes do not block each other due to changing accesses to the same database resources.

[Link to learn more ] (click)